COMPLAINT: Saskatchewan Government uses monthly utility bills to spread political propaganda and misinformation blaming federal government for pollution pricing.

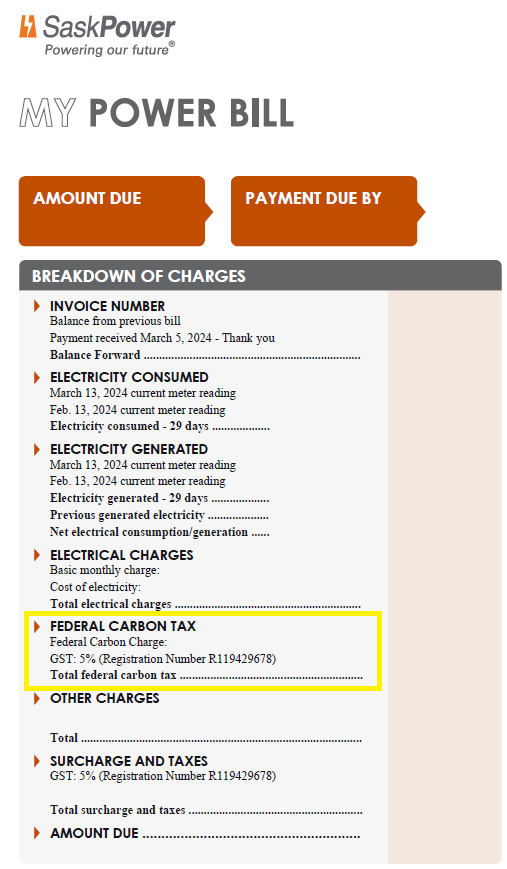

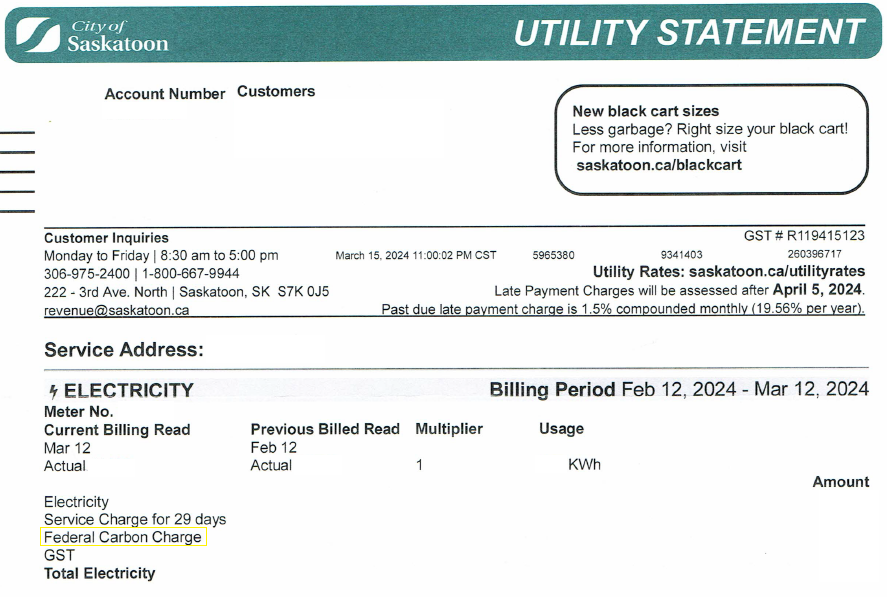

- Since April 1, 2019 SaskEnergy and SaskPower monthly utility bills have included a “Federal Carbon Charge” labelled under the large bold heading of “FEDERAL CARBON TAX”. A line item for “Total federal carbon tax” which includes GST is also redundant and misleading.

Words matter. Utility company and news media using the term “carbon tax” accepts a framing that the Supreme Court has rejected. Imagine how the story perception changes when we call it a price on pollution and place value on the environment rather than on finances and the economy. Whether or not people like/dislike pollution pricing is simply a matter of opinion. People opposed to pollution pricing tend to frame it in a negative way as a tax. In a climate crisis, focusing efforts to reduce emissions should not be a partisan issue.

- Effective Jan 1, 2023 – the Saskatchewan Output-Based Performance Standards (OBPS) program replaced the federally imposed carbon charge. SaskPower and other industrial emitters are obligated to remit OBPS compliance payments (carbon charges) to the Saskatchewan Government (NOT to the federal government). So Why is it still called a Federal charge/tax?

- City of Saskatoon utility bills also falsely label the carbon charge as Federal (should be Provincial)

Why were utility bills not updated to reflect these significant changes?

Who will hold our Sask Government and utility companies accountable?

The Federal Fuel Charge still applies in Saskatchewan and customers understand the term “Federal Carbon Tax” to be associated with the corresponding Canada Carbon Rebate. There is no rebate associated with the Saskatchewan OBPS program.

- The Saskatchewan Ombudsman is an independent Office that promotes fairness and takes complaints about provincial government ministries, agencies, Crown corporations and most health entities. In their own words, “The role of the Ombudsman Saskatchewan is to review administrative decisions of provincial and municipal government agencies. We are not mandated and do not have authority to implement new legislation or policies or override existing ones. In this case, the decision to use the term “Federal Carbon Tax” constitutes a policy decision and we are unable to review it. We did however consider the administrative aspect of your complaint, specifically whether you were provided the opportunity to raise your concerns and whether you received a response.“ I have argued that the monthly utility bill is an administrative process and that the Ombudsman should hold SaskPower accountable for their unfair actions and be transparent with customers about where these carbon charges are being remitted/managed.

- The Canada Competition Bureau, as a law enforcement agency, is responsible for the administration and enforcement of the Competition Act.

One type of anti‑competitive activity investigated by the Bureau - False or misleading representations: When materially false or misleading representations are made knowingly or recklessly to the public.

Resources and Information:

Carbon Pollution Pricing Systems in Canada

- June 21, 2018 – federal government’s Greenhouse Gas Pollution Pricing Act received royal assent

- Effective April 1, 2019 – pollution pricing would take effect in any province or territory which decides not to price pollution, or proposes a system that does not meet minimum national stringency standards (the federal ‘benchmark’).

- The federal pricing system has two parts: a regulatory charge on fossil fuels like gasoline and natural gas, known as the fuel charge, and a performance-based system for industries known as the Output-Based Pricing System. One or both parts can apply in a jurisdiction.

https://www.canada.ca/en/environment-climate-change/services/climate-change/pricing-pollution-how-it-will-work.html - In Saskatchewan, the federal fuel charge applies alongside the provincial carbon pricing system for industry.

- The Canada Carbon Rebate (formerly known as the Climate action incentive payment (CAIP)) is a tax-free amount to help eligible individuals and families offset the cost of the federal pollution pricing.

https://www.canada.ca/en/revenue-agency/services/child-family-benefits/cai-payment.html

Federal pollution pricing is not a tax!

- https://www.scc-csc.ca/case-dossier/cb/2021/38663-38781-39116-eng.aspx

- March 25, 2021 – The Supreme Court of Canada rules the federal carbon pricing law is constitutional.

- Not a tax – The majority noted that the term “carbon tax†is often used to describe the pricing of carbon emissions. However, they said this has nothing to do with the concept of taxation, as understood in the constitutional context. As such, they also concluded that the fuel and excess emission charges imposed by the Act were constitutionally valid regulatory charges and not taxes.

- How did the case get to the Supreme Court? Three provinces – Saskatchewan, Ontario and Alberta – challenged the constitutionality of the Act by referring the legislation to their respective courts of appeal. The courts of appeal for Saskatchewan and Ontario found the Act constitutional, while the Alberta Court of Appeal found it unconstitutional.

The question for the Supreme Court was whether the federal government had the authority to pass such a law that puts a price on carbon.

Saskatchewan's Carbon Tax

“a provincial plan has been approved to replace the federally imposed carbon tax on industrial emitters in the province, effective January 1, 2023. The Saskatchewan Output-Based Performance Standards (OBPS) Program meets the requirements for the 2023-2030 federal carbon pricing benchmark, including the addition of the electricity generation and natural gas transmission pipeline sectors.”

https://www.saskatchewan.ca/government/news-and-media/2022/november/22/federal-government-approves-saskatchewans-output-based-performance-standards-program

The provincial plan will apply to industrial emitters while the federal fuel charge will remain in Saskatchewan.

“On November 22, 2022, the federal government approved Saskatchewan’s proposal for an updated Output-Based Performance Standards (OBPS) program, which now includes electricity generation. As a result, the 2023-2030 carbon tax revenue we collect is paid to the provincial government.” – from SaskPower’s website:Â https://www.saskpower.com/Accounts/Power-Rates/Federal-Carbon-Tax

https://www.mltaikins.com/energy/saskatchewan-releases-emissions-reduction-regulations/

“If what this is going to result in is simply the same carbon tax now with half a billion dollars a year going to the provincial government instead of the federal government … Saskatchewan people and certainly myself as critic will have some follow up questions as details emerge,†she said.

https://regina.ctvnews.ca/ottawa-approves-saskatchewan-s-carbon-pricing-plan-1.6164026

“the federal plan to cut pollution from large emitters will no longer apply in Saskatchewan, making way for a provincially led plan.”

“Meanwhile, the federal fuel charge will continue to apply in Saskatchewan.”

https://www.cbc.ca/news/canada/saskatchewan/federal-gov-t-approves-saskatchewan-run-provincial-carbon-pricing-plan-1.6660014

December 4, 2023 – Government of Saskatchewan Amends Legislation to Support Clean Electricity Transition

“The Government of Saskatchewan is committed to ongoing transparency and accountability through the provincial budget, quarterly reports, and Public Accounts, including tracking how all OBPS Program electricity sector revenues are being used to support the province’s clean electricity transition.”

https://www.saskatchewan.ca/government/news-and-media/2023/december/04/government-of-saskatchewan-amends-legislation-to-support-clean-electricity-transition

Saskatchewan Budget 2024-2025 - revenue from OBPS

https://www.saskatchewan.ca/-/media/news-release-backgrounders/2024/mar/2024-25-budget.pdf

Page 48-49 of the budget –

- “In 2019, Saskatchewan OBPS Program was established in place of the federal carbon tax on large industrial and resource sector emitters in the province. OBPS compliance payments from non-electricity sectors are deposited in the Saskatchewan Technology Fund, which helps finance the adoption of technologies that reduce emissions at regulated facilities.”

- “the electricity sector has recently been added to the provincial OBPS in place of the federal carbon tax. OBPS compliance payments made by the electricity sector, primarily SaskPower, are deposited in the General Revenue Fund (GRF)“

- “The Small Modular Reactor Investment Fund will receive annual allocations from the GRF tied to electricity sector revenue and all investment income earned in the Small Modular Reactor Investment Fund will be retained in the fund.”

- “The Small Modular Reactor Investment Fund was established with an initial allocation of $326.3 million in 2023-24, which represents all OBPS electricity-sector revenue from January 1, 2023 – March 31, 2024. In the 2024-25 Budget, an additional allocation to the Small Modular Reactor Investment Fund of $242.1 million will be made, which includes forecasted investment income. By March 31, 2025, it is projected the Small Modular Reactor Investment Fund will be a $568.4 million asset for the province, with annual investment income growth accelerating in future years.”

Nuclear Energy Investment Fund:Â

Response: Blame the Federal Government

- “Carbon Tax is not decided by SaskPower, but rather the Federal Government. If you do have any further questions how it is charged, you will need to contact the federal government directly.” – response from SaskPower Customer Service Representative in my online account message centre.

- “Based on federal regulation, the province is required to collect the carbon tax. If the Province’s carbon tax system falls below the legislated minimum as set by the Federal government, the carbon tax reverts to the previous system where funds are remitted to the Federal government. Since, if there was no Federal carbon tax legislation, the Provincial government would not be collecting it, the charge is still referred to as a Federal Carbon Tax.” – response from Marni McIntyre, SaskPower Customer Care Consultant

- “The Province of Saskatchewan is required to collect the carbon tax based on Federal Government regulation. […] If there was no Federal Government carbon tax legislation, the Provincial Government would not be collecting it, and no additional GST would be charged. But that is not the case, and SaskPower must comply with existing law. That is why it is collected and still referenced as the Federal Carbon Tax.” – Rupen Pandya, President and Chief Executive Officer, SaskPower

The Government of Saskatchewan asserted regulatory authority over industrial carbon taxes

with their provincial OBPS Program.

“A day after Premier Scott Moe called for the federal carbon tax to be scrapped, he acknowledged the (provincial) OBPS is a carbon tax by another name.”

Response: Blame the Media

- “The reason we use the terminology “carbon tax” on the bill is that this is the most commonly used informal term for the federal carbon charge, including in news media. Using “carbon tax” on the bills helps to ensure customers clearly understand what the charge represents, compared to a more obscure technical term.” – response from Marni McIntyre, SaskPower Customer Care Consultant

- “Since the inception of the carbon tax by the federal government, the term carbon tax has been used in numerous media stories as well as on utility bills across Canada. […] Although other terms are sometimes used, the term carbon tax is by far the most used and understood by Saskatchewan people and other Canadians.” – Rupen Pandya, President and Chief Executive Officer, SaskPower

“Carbon charge” or “pollution price”

are not obscure technical terms.

People opposed to pollution pricing insist on

calling it a tax to impose negative connotations.

From the Ground Up - Episode 314

Listen to the podcast – Mark Bigland-Pritchard and Shannon Wright discuss the carbon charges on your utility bills.

“This compulsory charge to government revenue is levied on the cost of an activity, like a tax, and it is widely and commonly referred to as the “carbon tax,” which is what SaskPower and SaskEnergy refer to it as.

The carbon tax is the result of the federal government’s Greenhouse Gas Pollution Pricing Act (the Act) […] The federal government is the sole owner of the policy related to the Act.

The carbon tax applies to electricity generation that creates emissions. SaskPower recovers the expense associated with the federal carbon tax through a rate rider – a separate charge on your bill – in addition to basic monthly electricity rates.

SaskPower does not keep any of the carbon tax collected. The corporation is required to submit all carbon tax revenue collected during 2019-2022 to the Government of Canada. On November 22, 2022, the federal government approved Saskatchewan’s proposal for an updated Output-Based Performance Standards (OBPS) program, which now includes electricity generation. As a result, the 2023-2030 carbon tax revenue that SaskPower collects will be paid to the provincial government, effective January 1, 2023.“